How to Guide: Discover the Importance of Following Structured Instructions

Wiki Article

Exactly How to Develop a Detailed Budgeting Plan to Accomplish Financial Security and Control Over Your Expenditures

Developing a detailed budgeting strategy is important for accomplishing monetary security and keeping control over expenses. It starts with a precise evaluation of your present economic landscape, which includes reviewing revenue and costs. Comprehending the nuances of this procedure can significantly affect your economic trajectory and way of life selections.Analyze Your Existing Financial Scenario

To properly develop a budgeting plan, it is vital to thoroughly analyze your current economic situation. It is critical to calculate your complete monthly earnings precisely, as this figure will lead your budgeting decisions.Following, evaluate your expenditures by classifying them into dealt with and variable expenses. Set expenses, such as lease or home mortgage payments, insurance coverage, and utilities, stay consistent each month. On the other hand, variable expenditures, like groceries, enjoyment, and optional spending, can vary. Maintaining a comprehensive record of your investing routines over a couple of months can give insight right into locations where you may be spending too much.

Furthermore, take into consideration any exceptional financial obligations, including charge card equilibriums, pupil lendings, and personal fundings. Recognizing your responsibilities is essential for creating a strategy to take care of and minimize them successfully. By carrying out a complete analysis of your monetary situation, you can establish a strong foundation for your budgeting plan, eventually resulting in improved monetary stability and control over your expenses.

Establish Clear Financial Goals

Frequently setting clear monetary goals is essential for effective budgeting and lasting monetary success. Defining specific, quantifiable, attainable, pertinent, and time-bound (WISE) goals permits individuals to develop a roadmap for their financial trip. These objectives can include various aspects of individual money, consisting of conserving for retirement, acquiring a home, or repaying financial debt.To start, assess your top priorities and determine short-term, medium-term, and long-term objectives. Short-term objectives could include building a reserve or saving for a trip, while medium-term objectives could entail saving for a vehicle or moneying a youngster's education (How to guide). Lasting goals typically concentrate on retirement financial savings or riches accumulation

Next, evaluate your goals to supply clarity. Rather of intending to "save more money," define "conserve $10,000 for a down repayment by December 2025." This level of specificity not just improves inspiration but additionally assists in dimension of progress.

Finally, frequently testimonial and adjust your monetary objectives as situations transform. Life events such as task changes, family members development, or unexpected expenditures can affect your economic scenario, making it important to continue to be responsive and adaptable to achieve sustained economic stability.

Create Your Budget Framework

Establishing a budget plan structure is a basic action in bringing your financial goals to fruition. A well-structured budget plan framework acts as a plan for handling your earnings, costs, and savings, allowing you to align your spending with your read more financial goals.Begin by categorizing your expenditures right into optional and necessary groups. Essential expenditures include necessities such as housing, energies, groceries, and transportation, while optional costs incorporate entertainment, dining out, and luxury items. This classification helps you prioritize your investing and recognize locations where modifications can be made.

Next, determine your revenue resources and compute your overall regular monthly earnings. This must include wages, sideline, and any kind of passive income. With a clear picture of your income, you can allot funds per cost category better.

Include financial savings into your budget framework by establishing aside a specific percent of your earnings. This will aid you develop a reserve and add to long-lasting economic goals. A strong budget structure not only supplies clarity on your monetary scenario however additionally equips you to make educated choices that promote financial security and control over your expenses.

Monitor and Readjust Routinely

Tracking and readjusting your budget is important for keeping financial health and making certain that your costs aligns with your progressing goals. Consistently evaluating your spending plan enables you to determine disparities in between your prepared costs and real costs. This method assists you remain conscious and liable of your financial circumstance.Begin by establishing a consistent schedule for spending plan evaluations, whether it be regular, monthly, or quarterly. This evaluation can reveal patterns that require adjustments in your budgeting approach.

Remember, a budget is a living file that need to evolve with your financial situations. By proactively keeping track of and adjusting your budget, you can keep control over your costs and job in the direction of accomplishing your financial security goals.

Make Use Of Tools and Resources

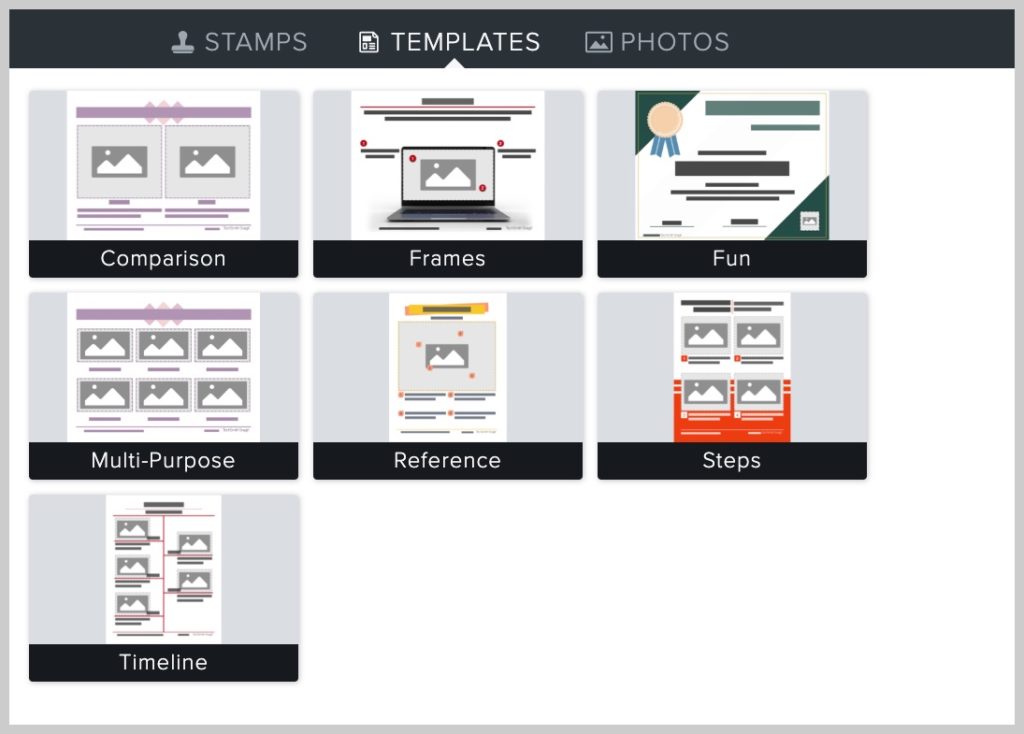

A broad range of resources and devices can considerably boost your budgeting process, making it easier to track costs and remain on target. Financial management software, such as Mint, YNAB (You Required a Spending Plan), or EveryDollar, provides easy to use interfaces for checking earnings and expenditures in real-time. These systems commonly feature automated monitoring of purchases, categorization of investing, and visual representations of your financial circumstance, assisting in informed decision-making.In addition to software application, mobile applications can use convenience and ease of access for budgeting on-the-go. Numerous applications permit the syncing of checking account, ensuring precise information while providing informs for upcoming costs or financial restrictions.

Furthermore, spreadsheets, such as Microsoft Excel or Google Sheets, can be customized to produce a customized budgeting system. These tools allow users to manually input data, assess trends, and task future expenses based on historical costs patterns.

Finally, think about leveraging educational sources such as budgeting workshops, online training courses, or financial blogs. These resources can strengthen your understanding of reliable budgeting strategies and help you make informed options that straighten with your economic objectives. Making use of these tools check this and resources is pivotal in attaining monetary stability and control over your expenditures.

Final Thought

By conducting a comprehensive evaluation of your financial situation, you can develop a solid groundwork for your budgeting plan, ultimately leading to improved economic stability and control over your costs.

By assessing the current financial situation, setting clear financial objectives, and producing an organized budget framework, individuals can efficiently designate resources. Utilizing economic management tools even more improves the budgeting process, ultimately leading to improved economic control and security.

Report this wiki page